First Time Buyer’s Field Guide

So you want to buy a house?

AWESOME! BUT WHERE DO YOU START?

PSSSSST… HINT HINT: READ BELOW!

Buying a house to turn into a home is one of the most exciting, and simultaneously terrifying, things to do. Your brain will be filled with all these What If questions: What if you buy the wrong house? What if there are unforeseen issues with the house? What if we get it and no longer like it? Etc, etc, etc. You can What If yourself to death.

Luckily for you, you aren’t the first or last “First time home buyer” to do this, and there is a wealth of information online about it. Everyone will have their own opinion of “the buying process”, but at the end of the day it is YOU who are buying the house and not them. Your best option is to team up with people who will make the process easier, less stressful, and have your best interest at heart.

To put the whole process into a nutshell here are the steps you will need to take to get you into your first home:

Step 1: Figure out how much you can afford.

Try this Mortgage Calculator to give you a rough idea of what you will be able to afford. This calculator will take into account your Income, Debt, Credit Score and what type of loan you will be using. Don’t know what type of loan you need/want? Don’t worry, I got a guy…actually I have a whole team. They rock.

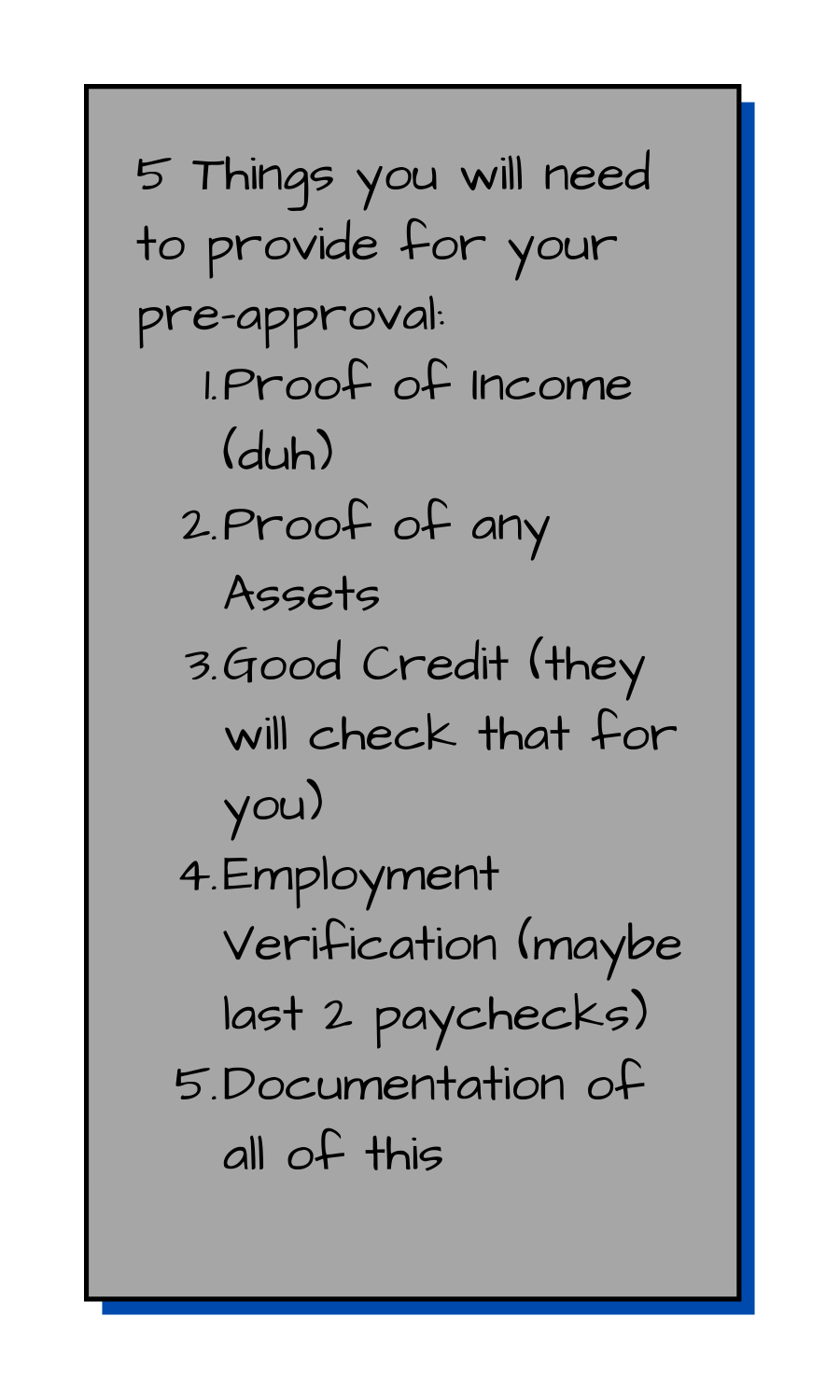

Step 2: Get Pre-Approved.

This is the number one thing that First Time Home Buyers mess up on, they start shopping BEFORE getting pre-approved. So if you are not pre approved yet and you see the house of your dreams, you wont be able to submit an offer immediately because you don’t even know if you can afford it. Then by the time you are pre-approved, your dream home is gone because someone else who was already pre-approved came in and put an offer on it right away. So before you go check any houses out, talk with my guy Joel Schaub over at Guaranteed Rate. Him and his team are all located in the Chicago-land area and they kill it up here. Go over to his page on Guaranteed Rate’s website, fill out some basic data, tell him Wade from Greystone Realty sent you and you’re in good hands from there. You can absolutely shop around and get multiple pre-approvals, but once again align yourself with someone who is going to take care of you during the whole process so you can focus on your life. Joel and his team will do just that.

Step 3: Start your new home search!

While you are waiting on your pre-approval letter, start and online search for your new home. Start by identifying and taking notes on:

What you like and don’t like.

Where you would and would not like to live.

Figure out how much square footage you would like to to take on.

Do you want a fixer upper, a ready to move in (turn key), 2-4 Unit (smart investment option here)?

Doing all of this will help when you see properties in person to make the quick decisions as to what is a hard pass, what has potential and what is the “Winner winner chicken dinner”

How Home Buyers Found the Home They Purchased

Step 4: Find your Realtor

Most of the time, a First Time Home Buyer will work with a Realtor. Your Realtor should, and I cannot stress this enough, make this whole process easier for you. They should be communicating with you constantly, and if they do not have the answer for you they get it and come back in a timely manner. Just like with lenders, interview a few Realtors to get an idea of who you will jive with. This person is going to navigate you through this big scary process, and the last thing you want is someone not looking out for your best interest.

Step 5: Look at properties!

This can be a really fun, or really long process. Since you have already done your due diligence and narrowed your wants and needs down, this should be a quick decision. You’ve looked at enough homes online and narrowed the list down, but to get the real feel you need to be in the space. See how the house functions. Does it make sense for you and your needs, or were the pictures so well done that it hides the truth of the listing? Did you just get Zillow Catfished?! By touring the property, being in it where you can physically touch it, you will be able to imagine yourself in it as YOUR home.

CAUTION!!!! Try your best not to look at a ton of properties in a day, or a week. If you look at too many in a short period of time, they will start blending together. You will remember things from one property and think it was in another property. Know your limit, listen to your agent, and make decisions quickly (especially in this market.)

Step 6: Submit your Offer (aka: shoot your shot)

You’ve found “The One” now its time to make your move, don’t wait until last call. Your agent will coach you through this process, and ensure that you feel confident that your offer is a solid one. This offer will include the price you are offering, inspections, contingencies and closing time lines. You want to have all your ducks in a row for this, and coming in with your pre approval letter to be your first page of your offer is a strong way to set the tone. Put your best foot forward because once you put it out there there’s almost no turning back.

Submit your offer ASAP. If you like the house, someone else probably does too, so don’t waste time. Trust your gut instinct. Your agent should not only email the offer over, but they should CALL the listing agent to give them the offer as well.

Things you should DEFINITELY do when submitting an offer:

Make sure you include inspections, even if you will waive the repairs list. You will 132168498% want to know what mechanically is going on in the house. (Ill talk about this more next.)

At the end of the day, offer what you want…it is your offer after all. Listen to your Realtor, but once again listen to your gut. Be proud of what you offered and stand by it.

Step 7: Get Your Home Inspection

Now that your offer is accepted, theres a lot of work that needs to happen really quickly. Typically within 4 business days you will have a home inspection to see the condition of the property. DO NOT SKIP THIS! Even if you waive the ability to have the seller fix anything, you still need this to happen, some loans won’t go to close without it. This is your opportunity to really dig into the property and ask the inspector questions about conditions of the property. Once the inspector is done, they will provide a report of their findings usually within 48 hours of their inspection.

Step 8: Order the Appraisal

This is typically done by by the lenders, not something you have to physically do yourself. This takes place to estimate the value of your home. The Appraiser will pull comparable properties to the one you are buying to make sure its value is what you are offering to pay for it. If the appraisal comes in under your offer price, likely you will have to make up that appraisal gap or get the seller to come down.

Step 9: Negotiation for Repair Items

If problems are identified during your inspection, you may have an opportunity to negotiate repairs or credit for the item in question. OR you could proceed without repairs or credits. Some small items like nics and dings in drywall or paint, the seller likely wont repair or credit you for them. But the big ticket items are the ones you want to be aware of, and if you can get some form of credit for them then its a win.

LAST BUT NOT LEAST! Step 10: Close the Sale!

WOOOOHOOOOO you made it to close! Get ready for the big day! Bring a good pen with you, stretch your writing hand, and get ready to sign hundreds of documents. These documents will vary from the promissory note for your loan, the deed, and the settlement statement. Don’t worry, this is the most painless part of the process except for your hand. Once its all said and done, congratulations you have yourself a new home! Welcome to the club, prep for your move, and get familiar with your local home improvement store’s layout!